tax sheltered annuity calculator

An annuity is a financial instrument that accrues interest on a tax-deferred basis and protects against market risk and longevity risk. The key feature of an.

The Tax Sheltered Annuity Tsa 403 B Plan

It is also known as a 403 b retirement plan and.

. If you withdraw money from your. Ad Get this must-read guide if you are considering investing in annuities. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

A 403 b plan. A tax-sheltered annuity plan gives employees. A 403b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well.

A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. Click Play to Play the Hero Carousel Content Click Pause to Pause the Hero Carousel Content. Annuity Contract Holders Get answers to questions.

The terms tax-sheltered annuity and 403b are often used interchangeably. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. It is an investment product that pays out income for a fixed term or life.

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. An Annuity Is A Retirement Product That Allows You To Take Income When You Need It.

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. You are only taxed on the. Just type in the keywords annuity calculator in the search engine.

A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way. Learn How Our Online Tools Can Help Answer Your Important Financial Questions. Annuities are often complex retirement investment products.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Ad Tax Deferral With An Annuity Can Help By Allowing Clients To Keep More In Retirement. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations.

ERISA Coverage Of IRC 403b. A Fixed Annuity can provide a very secure tax-deferred investment. Learn some startling facts.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. Ad Our Income Annuity Calculator Can Help You Plan For The Future. A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers.

Because annuities offer many benefits lottery winners. The most common tax-sheltered. If you want to know more about the tax status of annuities you may also use a free online calculator.

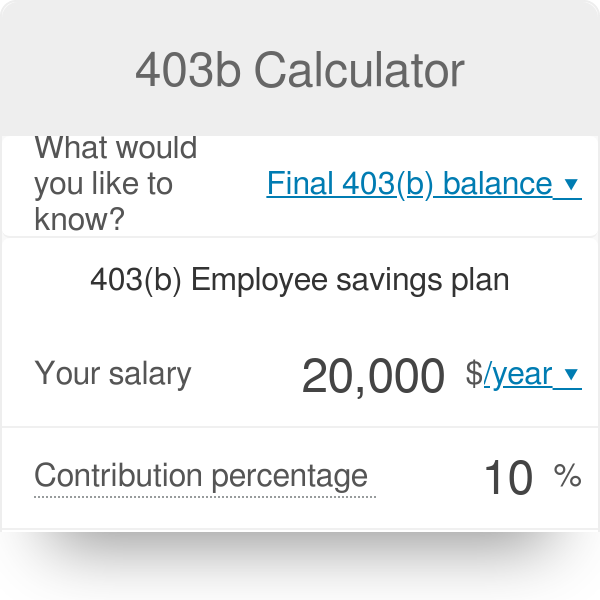

When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities. With this calculator you can find several things. A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain.

It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are withdrawn from the. The terms tax-sheltered annuity and 403b are often used interchangeably. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. An annuity can be seen as insurance against the risk of outliving ones assets. Ad See How Much Income An Annuity Can Provide With TIAA Retirement Calculators.

We Offer Innovative Products For Retirement That Help You Keep Your Plans. IRC 403 b Tax-Sheltered Annuity Plans.

Annuity Exclusion Ratio What It Is And How It Works

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Taxation How Various Annuities Are Taxed

What You Should Know About Tax Sheltered Annuities The Motley Fool

Annuity Investment Calculator Investment Annuity Calculator

Best Fixed Annuity Rates Up To 4 60 August 3 2022

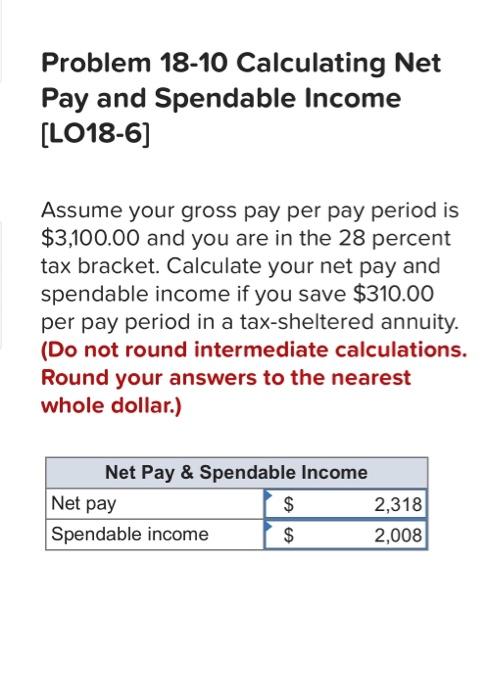

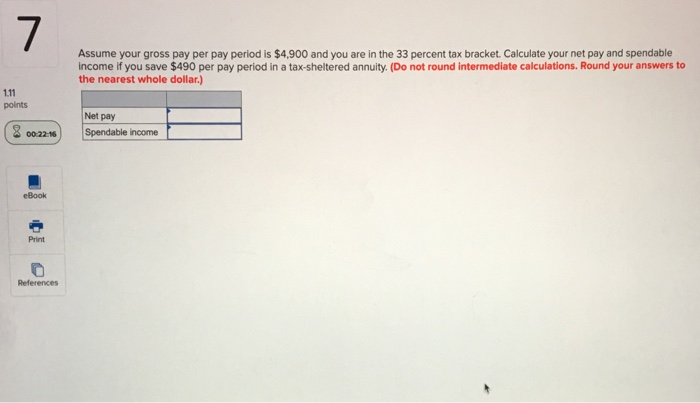

Solved Problem 18 10 Calculating Net Pay And Spendable Chegg Com

The Best Annuity Calculator 17 Retirement Planning Tools

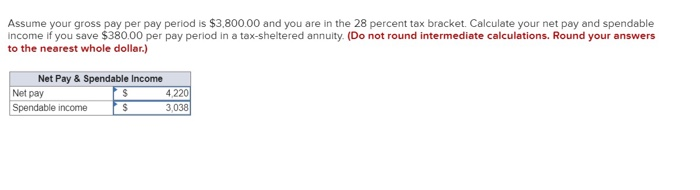

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

The Best Annuity Calculator 17 Retirement Planning Tools

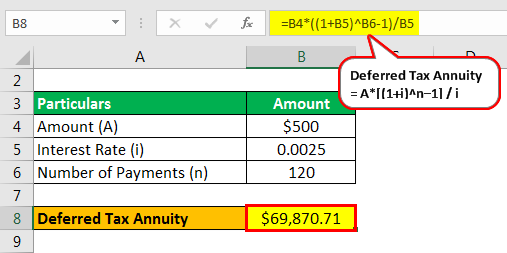

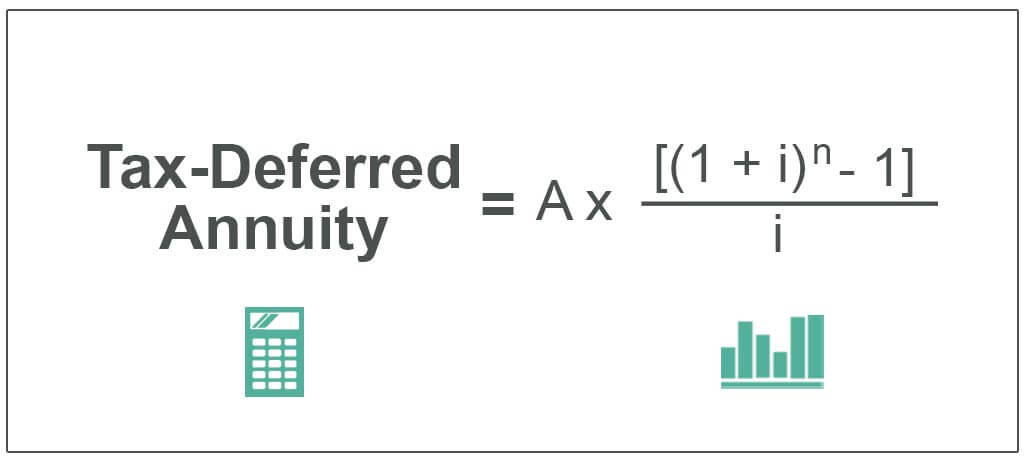

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Sheltered Annuity Plan Lovetoknow

Tax Deferred Annuity Definition Formula Examples With Calculations

Obamacare Investment Tax Problem For High Income Earners

The Best Annuity Calculator 17 Retirement Planning Tools

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com